What’s Your Plan B? Almost 60% of Dads have no Life Insurance

According to a new report from Scottish Widows, more than half (58%) of men with dependent children have no life insurance. That means that just over 4.5 million dads could be leaving their families with no financial protection if the worst was to happen to them.

Life insurance is designed to come to the rescue of your loved ones in the event of your death. It pays out a lump sum to those closest to you, relieving the financial worries from your family. It can help cover the cost of your mortgage, bills, general living expenses and funeral bills. Could your household survive without your income, a fifth of dad admitted that theirs wouldn’t.

If they were unable to work due to serious illness, 16% of fathers said they could only pay their household bills for a minimum of three months. 45% admitted they’d have to dip into their savings to manage financially. For the fathers that are the main breadwinners of the family, this can be extremely risky.

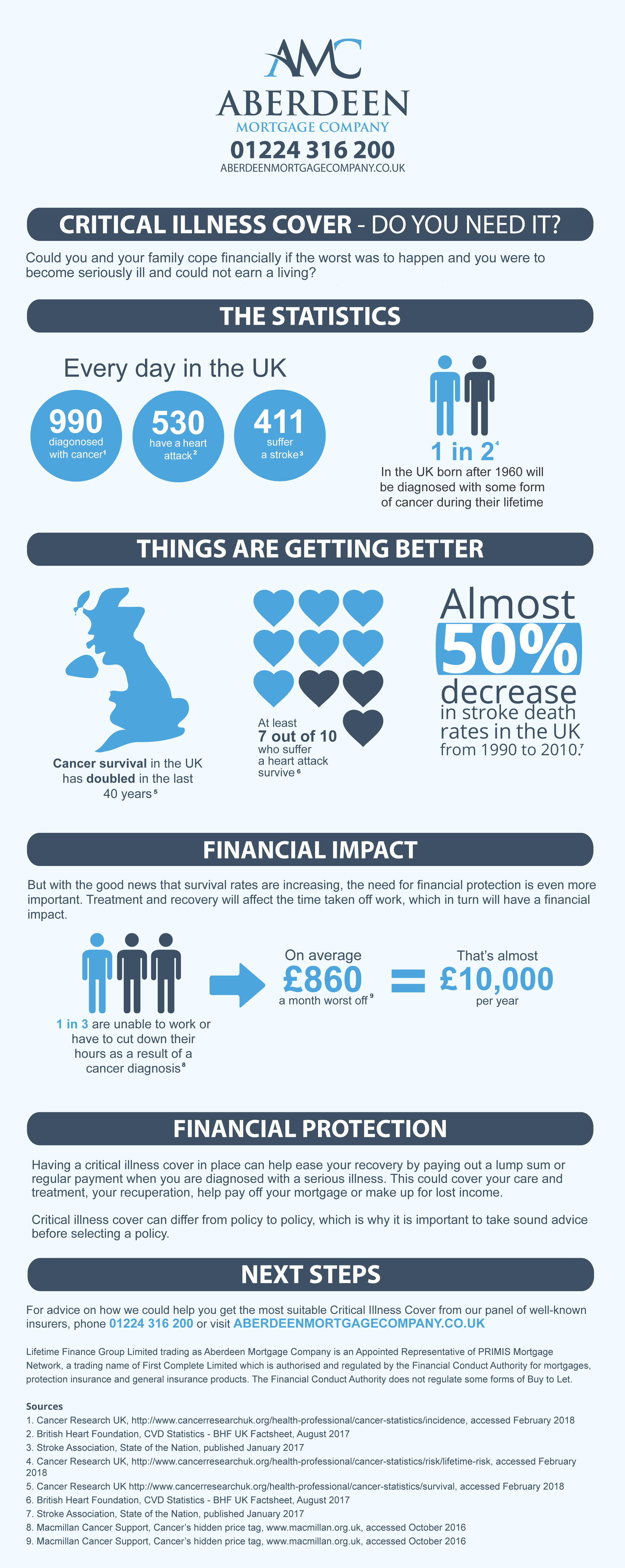

Critical illness cover comes to the rescue in the event you are diagnosed with a serious illness such as a cancer or stroke. It can help ease your recovery by paying out the money you need for your care and treatment, recuperation, help pay off your mortgage or make up for lost income.

You may not think of insurance as a necessity, but the value of protection is to provide long-term peace of mind about having financial security in place for your dependents.

Please note for these insurance products, terms and conditions apply. This information is a summary only. You will receive a full policy document upon application. This policy will set out the terms, conditions and limitations of cover provided under the plan.Source: 4.5 million UK dads have no life insurance – Scottish Widows – Cover, 2018, https://www.covermagazine.co.uk/cover/news/3034066/four-and-a-half-million-dads-have-no-life-insurance-scottish-widows

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.