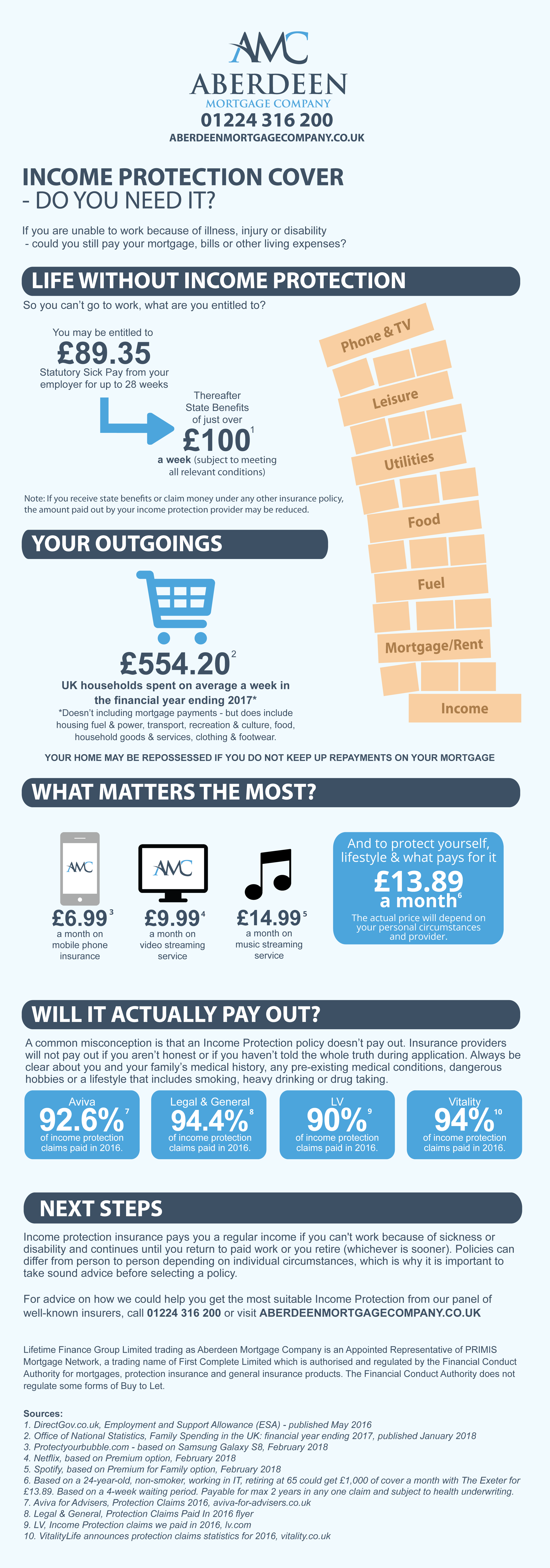

Critical Illness Cover – Do you need it?

/0 Comments/in Guides, Protection /by Neil CarruthersCritical Illness Cover – Do you need it?

Could you and your family cope financially if the worst was to happen and you were to become seriously ill and could not earn a living?

11 Mortgage Words You Should Learn When Buying a House

/in First time buyer, Guides, New Build Mortgage /by Neil CarruthersArranging your mortgage and buying a new build property is an exciting time. However, the jargon that is used throughout the process can be confusing. We’ve put together a jargon buster to help you along the way during your house buying process.

Your property may be repossessed if you do not keep up repayments on your mortgage.

If you’re considering buying a new-build property and want advice on the best mortgage options for you, request a callback from our expert mortgage advisers.

-

Agreement in Principle

This is the agreement provided by the mortgage lender which states the amount they are prepared to lend to you subject to a full mortgage application with supporting documentation and their enquiries during underwriting being satisfied. It’s useful if you haven’t found a property to buy but would like to know how much you could potentially borrow.

-

Conclude Missives

The contract is normally formed by missives of sale between the solicitors on behalf of each the seller and purchaser. Missives are letters of body of which contain proposed sale contracts and negotiate terms. Once all the contractual terms are agreed, the missives are said to be concluded, and these serve as a binding contract for the sale of the property.

-

Conveyancing

The process of transferring the legal title of property from the seller to you.

-

Disbursements

This is money that your solicitors have had to pay to third parties during the conveyancing process, and which they will claim back from you. Disbursements will include things like search fees and land registry fees. Check that disbursements are included in your quote (most are known in advance) otherwise your bill could be a lot higher than you expect.

-

Land & Buildings Transaction Tax

This is the tax charged by the Scottish Government for buying a property/land. The amount varies depending on the value of the property.

-

Land Registry Records

These records state who owns what land/property. When a property changes hands your solicitor will make sure this transfer is recorded at the Land Registry.

-

Local Authority Search

A search that asks the local authority about things that may affect the property, such as : whether the road the property stands on is maintained by the council, planning applications that may affect the property, possible planning restrictions, and rights of way.

-

Mortgage

This is the loan used to buy a property. Because it is secured on the property being bought the property cannot be sold until the mortgage is paid off (either at the end of its term or, if you are selling, by using proceeds from the sale to pay off the balance).

-

Mortgage Deed

The legal charge that gives the mortgage lender rights over the property until the mortgage has been repaid.

-

Mortgage Valuation

This is the valuation survey carried out by your bank or building society before they will lend on a property. This will help determine how much a lender is willing to lend.

-

Title Deeds

The documents that prove ownership of a property and which set out any rights or obligations affecting the property. If the property is mortgaged then the deeds may be held by the mortgage lender.

For any queries speak to our expert mortgage advisers at Aberdeen Mortgage Company, call 01224 316200 or fill in our online enquiry form.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

This firm charges a fee of up to £395 for mortgage advice. The amount of fee will depend on your circumstances and will be discussed and agreed with you at the earliest opportunity.

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

6 Reasons to Buy a New Build Property

/in First time buyer, Guides, New Build Mortgage /by Neil CarruthersBuying a new build property can be exciting. With more and more developments popping up, we look at 6 reasons why a new build property could be perfect for you.

If you’re considering buying a new-build property and want advice on the best mortgage options for you, speak to our expert advisers.

-

Your structure is covered

The majority of new-build homes come with a 10-year NHBC (National House Building Council) warranty (check with the development you’re visiting). This provides protection to house buyers for any structural defects. Some house builders also provide their own two-year warranty.

-

It’s a blank canvas

A new house is fresh, bright and clean. With no previous owners, you have a blank canvas to design how you want. Add your own style to each room without having the cost of stripping wallpaper and removing carpets.

-

Help to Buy

The Scottish Government’s Help to Buy affordable new build scheme, helps buyers buy a new build home with minimum 5% deposit. The Government then take an equity stake of up to a maximum 15% of the value of the property. Our mortgage advisers can help you with schemes like Help to Buy.

-

Energy-efficient

New build homes are built to the latest environmental standards. They are super insulated, resulting in new build properties being six times more energy efficient than houses built in Victorian times*.

Research from the NHBC Foundation has shown that living in a new home could result in savings of around 55% on gas and electricity spending*.

-

Incentives

Check the builder’s sales website before you go. Some of them may be offering incentives, such as paying for your land and buildings transaction tax or even upgrading your kitchen worktops. Also, there’s no harm in asking if there’s anything extra they are willing to help you with.

-

No previous owners to annoy you

With a new build property, you won’t have to wait on the owners of the property finding somewhere else to live. Once you’ve reserved your property, you’ll then be given a completion date so that you are able to start planning your move.

While the reasons to buy a new-build are strong, there are always disadvantages – such as if there are any delays in construction, your mortgage offer could expire.

We, at Aberdeen Mortgage Company, are new-build mortgage specialists. For any queries, call 01224 316200 or fill in our online enquiry form.

*NHBC – Why Buy This Home? Accessed April 2018

_ _ _ _ _ _ _ _

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

This firm charges a fee of up to £395 for mortgage advice. The amount of fee will depend on your circumstances and will be discussed and agreed with you at the earliest opportunity.

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

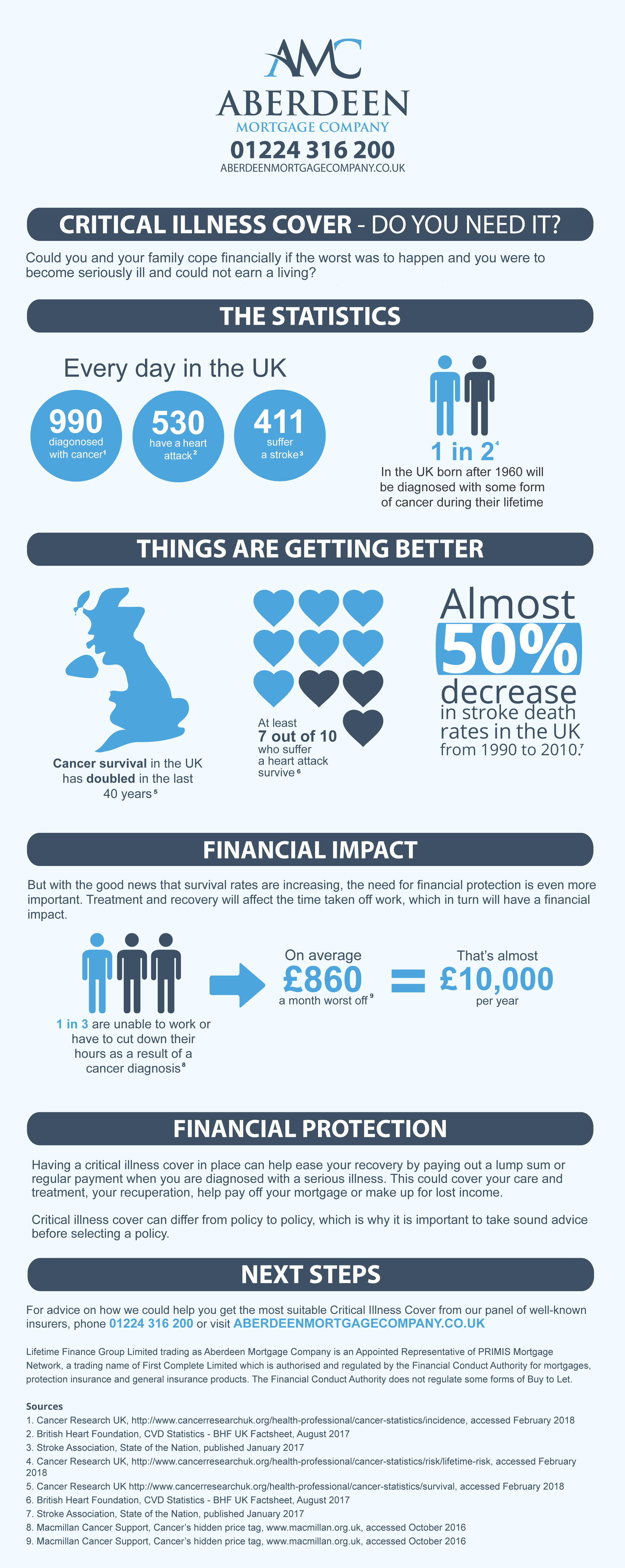

Life Insurance – Do You Need It?

/in Guides, Protection /by Neil CarruthersCould your children, partner or relatives survive without your income? Would they have enough to cover the mortgage or other living expenses? Life insurance pays out a lump sum or monthly payment to your family in the event of your death.

Click on infographic for larger image.

Help to Buy ISAs – What first time buyers need to know

/0 Comments/in Guides /by Neil CarruthersIn March 2015, the Government outlined a new Help to Buy ISA and has recently released more details. It sees the Government adding £50 to every £200 first-time buyers manage to save towards a deposit for their first home.

When does it begin?

The start date for the scheme will be the 1st December 2015, and it will run for four years. You can open this account anytime within this four years.

Who is it for?

It’s only available to first time buyers, and just like a cash ISA you must be aged 16 and over. If you’re buying with someone who isn’t a first-time buyer, they won’t be able to open one but you will be as the account is available per person rather than per home.

What type of house can I buy with it?

You’ll be able to use the Help to Buy ISA for house purchases up to £250,000, or if you are in London up to £450,000. This ISA is for a residential mortgage only and can either be for a new-build home or a second-hand home.

How much could I put in my account every month?

The maximum amount you can contribute monthly is £200, with an initial deposit of up to £1,000. The Government will then add in 25% of what you pay in every month. There is no minimum monthly deposit required.

A maximum government bonus that can be achieved through the scheme is £3,000.

Will interest rates be added on?

You will earn interest rates like a normal cash ISA and also the government bonus added on at the end.

The bonus will apply to both the amount a person saves into their Help to Buy: ISA and the interest that is built up during the period the account is open.

Where can I get one?

Some of the banks and building societies announced participating in the Government’s scheme are Barclays, Lloyds Banking Group, Nationwide, NatWest, Santander and Virgin Money.

When do I get the bonus?

The scheme will be designed to ensure that the government bonus is used as intended. The government bonus will therefore only be paid at the point a first home is purchased.

What is the scheme duration?

Once an account is opened there is no limit on how long you can save into the Help to Buy ISA. There is also no time limit on when you can use your government bonus. But you will stop earning a bonus from the government once you reach £12,000.

Can I pay into a cash ISA and a Help to Buy ISA at the same time?

You can only pay into one cash ISA in a tax year. You would not be able to pay into both a cash ISA and a Help to Buy ISA at the same time.

If you’re a first time buyer in Aberdeenshire looking to make your first step onto the property ladder, call us now for mortgage and protection advice on 01224 316 200 or fill in our online enquiry form.

Help to Buy ISAs are not regulated by the Financial Conduct Authority. Terms and Conditions apply.

Please note that Aberdeen Mortgage Company Ltd do not offer or provide advice on Help to Buy ISAs.

The above text is high level generic information only and should you require detailed or specific information on the products available, you should seek specialist advice from a suitably qualified source.

Sources:

BBC News – “Banks offering Help to Buy ISA named” published 25th July 2015.

HM Treasury – “Help to Buy ISA scheme outline” published 18th March 2015

HM Treasury – “Help to Buy ISA fact sheet” published 22th July 2015