60% of Stroke Victims Fall Within Working Age

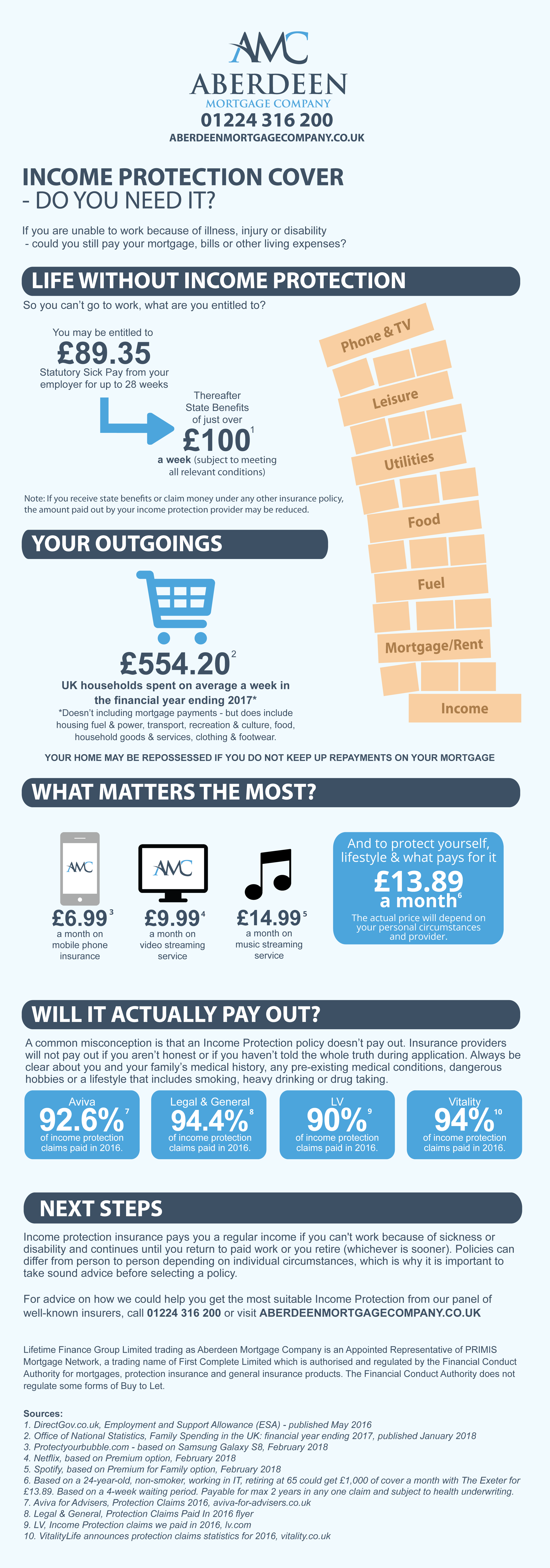

Could you and your family cope without your income?

Recent statistics released by RedArc have shown almost two-thirds of stroke victims (60%) fall within the traditional working age bracket of 40 to 59.

One in four of the 100,000 strokes in the UK each year [1] happen to people of working age or younger. Almost two-thirds of stroke survivors leave hospital with a disability [2].

So not only does a stroke incur significant recovery time but it can also require potential rehabilitation too. Time spent recovering could mean time away from work, therefore having a safety net in place is essential.

Having cover in place such as Income Protection or Critical Illness Cover can help ease your recovery by paying out a lump sum or regular payment when you’re diagnosed with a serious illness. This could cover your care and treatment, your recuperation, help pay off your mortgage or make up for lost income.

Insurance can differ from policy to policy, which is why it is important to take sound advice before taking out a policy.

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

Source:

[1] Different Strokes, January 2018

[2] Stroke Association, State of the Nation, published January 2017