Protecting against the cost of injury: Introducing Legal & General Fracture Cover

Anyone can have a sudden injury – whether a slip on the stairs, car crash, or fall outdoors. This could require time off work, extra childcare, expensive travel costs, and even equipment to support your mobility. Not everyone would receive sick pay from an employer. And even if you did – the extra expenses may not be affordable without the cash sum that protection can provide. Fracture cover is here to help.

How does Fracture Cover work?

- Fracture Cover can be added to life insurance, critical illness, income protection and rental protection policies, for an additional monthly premium of £5.90.

- It covers 20 types of fractures, 9 types of joint dislocation, Achilles tendon ruptures and knee ligament tears

- Multiple claims are permitted per year – including accidents where multiple injuries are sustained at one time or in a 12-month period.

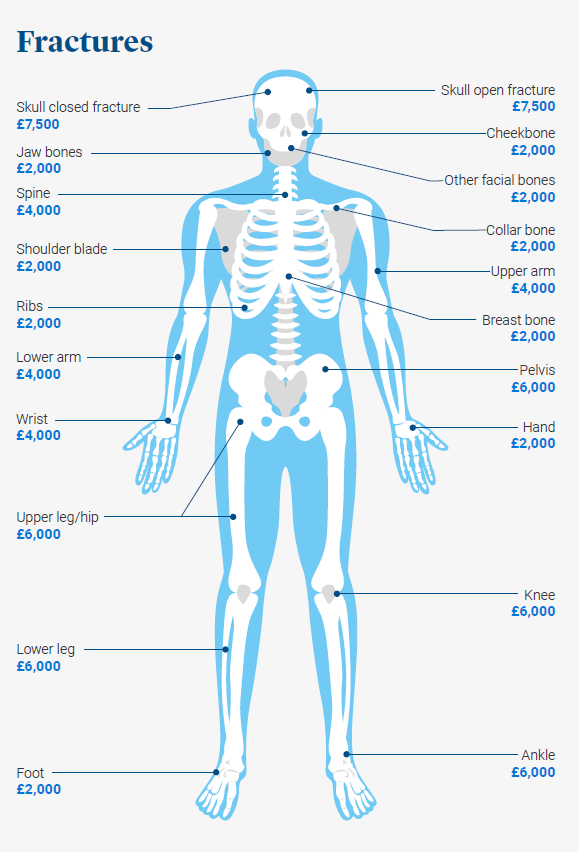

- Depending on the injury severity, claim pay outs are £2,000, £4,000, £6,000 or maximum of £7,500

What’s covered?

See below to see how Legal & General’s Fracture Cover could help ease the pain

What fractures are covered?

What dislocations, ligament tears and tendon ruptures are covered?

Our expert protection specialists can help discuss the right protection solutions for your, your family and your home. Speak to our expert protection advisers today, call 01224 316200 or fill in our online enquiry form.

This information is a summary only. You will receive a full policy document upon application. This policy will set out the terms, conditions and limitations of cover provided under the plan.