What is the First Home Fund?

The First Home Fund is a £200 million shared equity pilot scheme to provide first-time buyers with up to £25,000 to help them buy a home.

It is open to all first-time buyers in Scotland and can be used to help buy both new build and existing properties.

The First Home Fund is run by the Scottish Government and aims to help first-time home buyers purchase a property. Up to £25,000 is available to all first-time buyers towards the purchase of both new build and existing properties. A first-time buyer is anyone who does not own, or has previously owned, a property in Scotland or anywhere else in the world.

In order to take part in the scheme, you will be required to provide a minimum deposit of 5% (subject to individual lender requirements, but any amount over valuation must be cash funded) and your mortgage must be at least 25% of the purchase price. Although the Scottish Government will have an equity share in the property, you will own the property outright. There are no monthly payments to be made towards the Scottish Government and no interest will be charged.

What you need to know

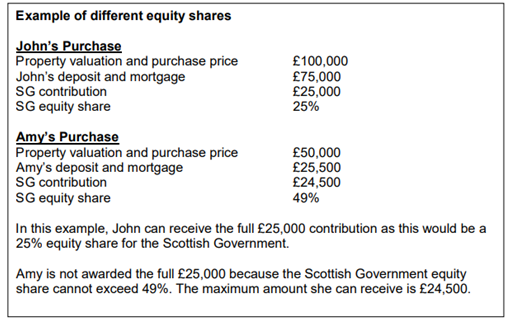

- The maximum contribution from the Scottish Government is £25,000 or up to 49% of the property valuation figure or the purchase price (whichever is lower).

- There is a limit of one application per property. You can submit a joint application however you will be limited to one award of £25,000.

- Your mortgage must be at least 25% of the purchase price.

- The property must be the sole residence of all applicants.

- The scheme is not available for buy-to-let properties.

To find out more about what you can borrow as a first time buyer, speak to our expert mortgage advisers today. Call 01224 316200 or fill in our online enquiry form.

Who is Aberdeen Mortgage Company?

Aberdeen Mortgage Company (AMC) are award-winning mortgage and protection experts. We have helped clients throughout Aberdeenshire secure the property of their dreams. AMC caters for a range of clients and property, be it first time buyers looking at a new build or experienced landlords expanding their buy to let portfolio. Beyond mortgages, Aberdeen Mortgage Company also advises on home insurance as well as life protection.

Your home may be repossessed if you do not keep up repayments on your mortgage.

This firm charges a fee of up to £595 for mortgage advice. The amount of fee will depend on your circumstances and will be discussed and agreed with you at the earliest opportunity.

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority