What’s Your Plan B? Almost 60% of Dads have no Life Insurance

/in Protection /by Neil CarruthersAccording to a new report from Scottish Widows, more than half (58%) of men with dependent children have no life insurance. That means that just over 4.5 million dads could be leaving their families with no financial protection if the worst was to happen to them.

Life insurance is designed to come to the rescue of your loved ones in the event of your death. It pays out a lump sum to those closest to you, relieving the financial worries from your family. It can help cover the cost of your mortgage, bills, general living expenses and funeral bills. Could your household survive without your income, a fifth of dad admitted that theirs wouldn’t.

If they were unable to work due to serious illness, 16% of fathers said they could only pay their household bills for a minimum of three months. 45% admitted they’d have to dip into their savings to manage financially. For the fathers that are the main breadwinners of the family, this can be extremely risky.

Critical illness cover comes to the rescue in the event you are diagnosed with a serious illness such as a cancer or stroke. It can help ease your recovery by paying out the money you need for your care and treatment, recuperation, help pay off your mortgage or make up for lost income.

You may not think of insurance as a necessity, but the value of protection is to provide long-term peace of mind about having financial security in place for your dependents.

Speak to our expert protection team about arranging the most suitable protection policy, call 01224 316200 or fill in our online enquiry form.

Source: 4.5 million UK dads have no life insurance – Scottish Widows – Cover, 2018, https://www.covermagazine.co.uk/cover/news/3034066/four-and-a-half-million-dads-have-no-life-insurance-scottish-widows

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

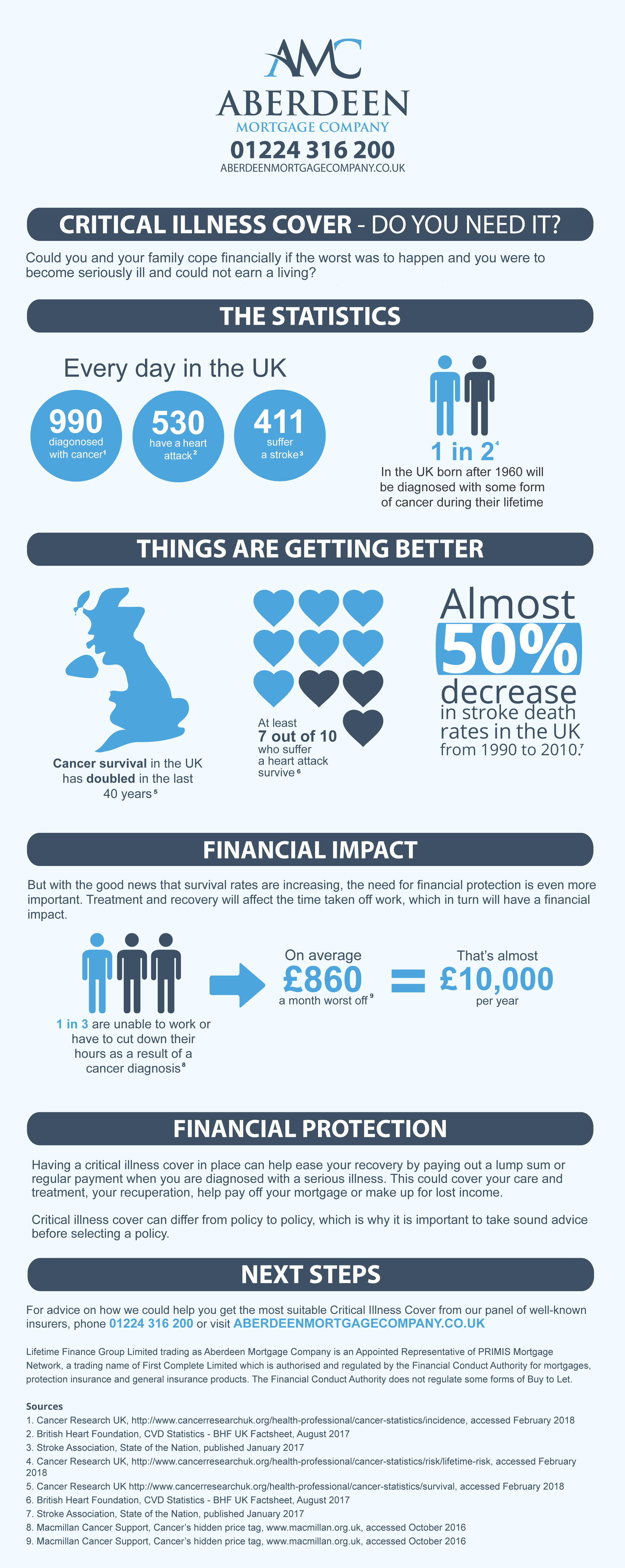

Critical Illness Cover – Do you need it?

/in Guides, Protection /by Neil CarruthersCritical Illness Cover – Do you need it?

Could you and your family cope financially if the worst was to happen and you were to become seriously ill and could not earn a living?

60% of Mums With Dependent Children Have No Life Cover

/in Protection /by Neil CarruthersWith Mother’s Day approaching, we reflect on the importance of mothers in our lives, yet a high percentage of them maybe financially unprotected.

According to a Scottish Widows’ survey of 5,077 adults in the UK, 60% of women with a dependent child have no life insurance.

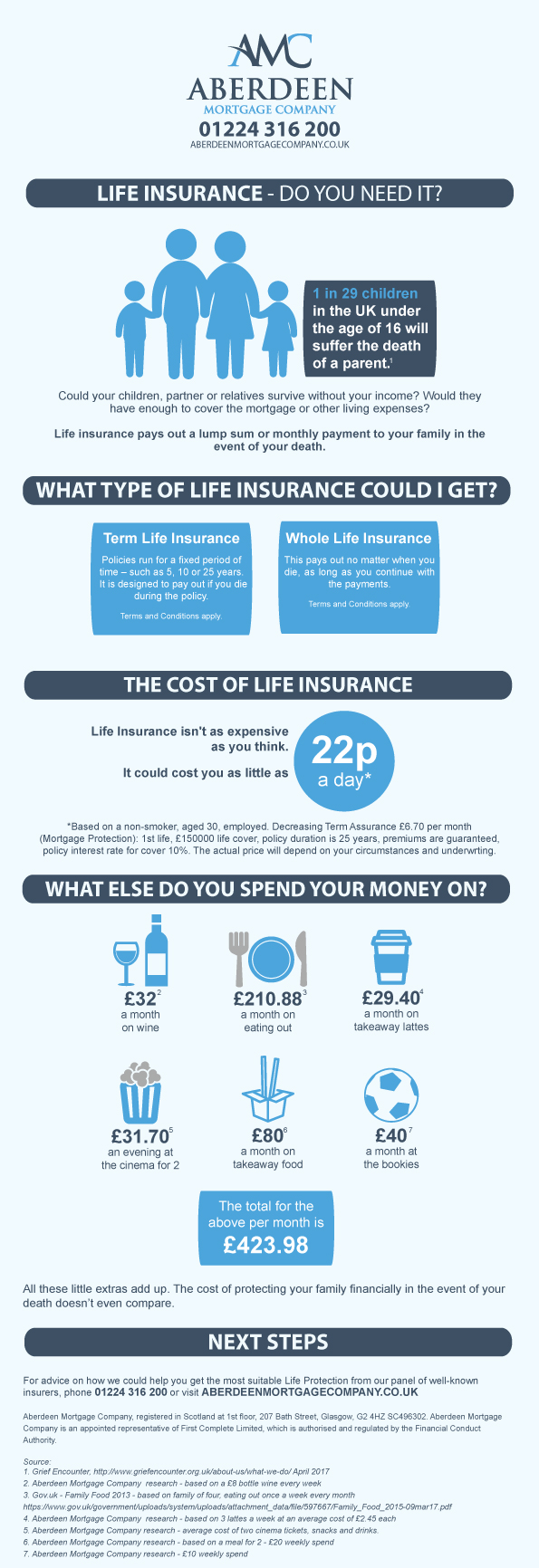

The importance of life insurance

Life insurance comes to the rescue in the event of death. It guards your home and the people in your life by financially protecting them. If you were to die would they have enough to cover the mortgage, bills, general living expenses and funeral costs without you?

1 in 29 children in the UK under the age of 16 will suffer the death of a parent*.

*Source: Grief Encounter, http://www.griefencounter.org.uk/about-us/what-we-do/, February 2018

Life Insurance isn’t as expensive as you think. It could cost you as little as 22p a day**

**Based on a non-smoker, aged 30, employed. Decreasing Term Assurance £6.70 per month (Mortgage Protection) 1st life, £150000 life cover, policy duration is 25 years, premiums are guaranteed, policy interest rate for cover 10%. The actual price will depend on your circumstances and underwriting.

Only 13% of mums have critical illness cover

The Scottish Widows’ survey also reports that a very small percentage of mothers have critical illness cover. Critical illness cover is just as important as life insurance (if not more).

About 31% of mothers admitted their household would be placed at financial risk if they lost their income unexpectedly. 25% claimed they could only pay their mortgage for a maximum of three months. 39% said they would have to use their savings to cover themselves financially if placed in adverse circumstances.

The importance of critical illness cover

Critical illness cover pays out if the worst happens, and you’re diagnosed with a critical illness (specified in your policy) such as cancer or stroke, including children’s critical illness.

Having a Critical Illness Cover in place can help ease your recovery by paying out the money you need for your care and treatment, your recuperation, help pay off your mortgage or make up for lost income.

Speak to one of our expert life insurance advisers about getting the right protection for you. Call 01224 316 200 or request a callback.

Source: Scottish Widows, 2018, http://reference.scottishwidows.co.uk/docs/2018-03-mothers-day-protection.pdf

Please note for these insurance products terms and conditions apply. This information is a summary only. You will receive a full policy document upon application. This policy will set out the terms, conditions and limitations of cover provided under the plan.

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

4 Myths of Critical Illness Cover… Dispelled

/in Protection /by Neil CarruthersCritical Illness Cover is designed to pay out a lump sum or regular payment to ease your recovery if the worst was to happen and you are diagnosed with a serious illness specified in your policy.

Common myths surrounding critical illness may result in people being reluctant to take out a policy, even though you may well need this type in your lifetime. We’re here to answer some of these myths.

-

“It’ll never happen to me”

Most people believe that a critical illness will never happen to them, but most of us know of someone either directly or through friends and family that has been affected. When considering Critical Illness Cover, it’s worth thinking about the effect of not being protected.

With the good news that survival rates are increasing for certain conditions*, the need for financial protection is even more important.

*Cancer Research UK, http://scienceblog.cancerresearchuk.org/2018/02/03/news-digest-cancer-survival-breast-cancer-drug-cancer-jab-trials-and-vaping/, February 2018

-

“I’m too young”

No one wants to think they’ll be struck down with a critical illness – but it can affect anyone, at any age and any time.

- The age group of 0-24 has the greatest increase in cancer incidence rates since the early 90s.*

- In females aged 25-49 years, breast cancer is the most common cancer, accounting for more than 4 in 10 (44%) of all cases in 2013-2015.*

- Multiple sclerosis (also known as MS) is the most common neurological disorder among young adults in the UK. It’s possible for MS to occur at any age, but in most commonly diagnosed in people in their 20s and 30s.**

*Cancer Research UK, http://www.cancerresearchuk.org/health-professional/cancer-statistics/incidence/age#heading-Five, Accessed February 2018.

** NHS, http://www.nhs.uk/Conditions/Multiple-sclerosis/Pages/Introduction.aspx, published 2016.

-

“It’s too expensive”

The cost of cover changes due to various factors, these include:

- Age

- Sex

- Health

- Family history

- Occupation

- Smoker/Non-smoker

Generally, the younger and fitter you are, the cheaper the cover.

You can also choose to buy critical illness as an add-on to a life insurance policy. It can work out cheaper, but it usually means the policy will only pay out once. So if you made a critical illness claim, there wouldn’t be a pay-out when you die.

-

“Life companies never pay-out”

97% of protection claims were paid out*, including 98% of term life insurance claims and 93% of critical illness claims.**

*Excludes Group Income Protection

**ABI UK Insurance Key Facts 2016 https://www.abi.org.uk/globalassets/sitecore/files/documents/publications/public/2016/keyfacts/keyfacts2016.pdf

Next steps

When taking out a critical illness policy, you should ensure you are aware of the conditions that are covered, these could include: cancer, heart attack, heart bypass, kidney failure, major organ transplant, multiple sclerosis and stroke. Cover can differ from policy to policy, which is why it is important to take sound advice before selecting a policy.

Speak to our expert advisers about the most suitable Critical Illness Cover from our panel of leading insurers

Please note for these insurance products, terms and conditions apply. This information is a summary only. You will receive a full policy document upon application. This policy will set out the terms, conditions and limitations of cover provided under the plan.

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

6 Life Insurance FAQs – Answered

/in Protection /by Neil CarruthersLife Insurance can be confusing especially with the different jargon that gets used. All you want to do is make sure you’ve setup the right cover for you and your family. Our blog sets out to answer some of those most asked questions about life insurance.

-

What types of cover can I get?

- Level Cover

- This means the amount of cover and the premium you pay is fixed when your plan starts, and doesn’t change.

- Decreasing Cover

- This type of cover is designed to cover the reducing amount on a capital and interest repayment mortgage. The amount of cover will go down each month, but the premium you pay is fixed when your plan starts and never changes.

- Joint or Single Cover

- You can choose to take out a plan that covers just yourself, or your spouse, civil partner or someone you share a financial commitment with.

- Level Cover

-

What’s the difference between level cover and decreasing cover?

Level life cover provides the same amount of cover throughout the term of the policy. For example, if you chose £150,000 over the next 30 years and died in the last year, you’d get the full £150,000.

Decreasing cover reduces over the term of the policy and is usually cheaper than level cover. Decreasing life cover policies pay-outs usually reduce in line with your mortgage.

-

Should I get a joint policy?

Joint life insurance policies can be taken out with you spouse, civil partner or someone you share a financial commitment with. It’s usually cheaper than two separate insurance policies. The policy only pays out once – meaning if one partner died, the other would no longer have their life insured.

-

I have life insurance through my employer, do I need more?

Life insurance is sometimes offered as a benefit from employers. It is often known as “death in service”. A reminder though, if you were to leave or lose the job, the cover would stop

-

Should I put my Life Insurance in a trust?

A trust is a legal arrangement that allows you to gift the proceeds of your life insurance policy to the individuals you specify. If your life policy isn’t held in trust, it will be normally be considered part of your estate. Putting it in trust will mean it could be exempt from inheritance tax, increasing the amount of many passed on to your loved ones.

-

Will existing medical conditions affect my policy?

If you have any existing medical conditions you’re more likely to pay a higher premium or may find it harder to get insured. Sometimes you can arrange a policy that excludes the pre-existing condition from your cover.

Speak to one of our expert life protection advisers.

Please note for these insurance products terms and conditions apply. This information is a summary only. You will receive a full policy document upon application. This policy will set out the terms, conditions and limitations of cover provided under the plan. Please note that Aberdeen Mortgage Company Limited does not offer advice on taxation matters. You should contact your accountant or other suitably qualified person to confirm whether this product is appropriate for your circumstances.

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

Life Insurance – Do You Need It?

/in Guides, Protection /by Neil CarruthersCould your children, partner or relatives survive without your income? Would they have enough to cover the mortgage or other living expenses? Life insurance pays out a lump sum or monthly payment to your family in the event of your death.

Click on infographic for larger image.

CLIENT STORY: It pays to remember WHY you have critical illness cover

/in Protection /by Neil CarruthersCritical Illness Cover [definition] Critical Illness Cover pays out when the worst happens and you’re diagnosed with a serious illness such as cancer or stroke.

At the age of 37, one of our clients received the worst news. She had been diagnosed with thyroid cancer. The worst diagnosis you could ever receive. Sadly, there are 980 cases of cancer diagnosed every day*.

Thankfully, our client made a full recovery. She returned to good health and went eventually back to work. Even though she had critical illness cover in place, she did not make a claim.

This all happened 10 years ago.

Now in 2017, during a review of her life insurance, our client told our Life Protection specialist Julia all about this. Julia questioned why our client had never claimed. She replied, she never thought to as the cancer had been removed and she had fully recovered.

Julia advised to get in contact with her insurer. The payments you make every month to your insurer is in case something like this happens. Our client then proceeded to complete a claim form and send over her medical details. The insurer reviewed what she sent, and paid her over £40,000!

This was money she was due. The point of having critical illness cover in place is to help ease recovery if the worst was to happen. The money paid out can be used for care and treatment, recuperation, or make up for lost income.

We cannot emphasise enough how important it is to review your protection policies. If you haven’t reviewed in a number of years, or if you even think you may be due a claim – please don’t hesitate to get in contact with us. Call 01224 316200 or fill in our online enquiry form.

Source: *Cancer Research UK, http://www.cancerresearchuk.org/health-professional/cancer-statistics, accessed March 2017.

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

The True Cost of Cancer

/in Protection /by Neil Carruthers September is not just Childhood Cancer Awareness Month but also host to the highly popular World’s Biggest Coffee Morning for MacMillan Cancer Support and Dryathlon for Cancer Research UK.

September is not just Childhood Cancer Awareness Month but also host to the highly popular World’s Biggest Coffee Morning for MacMillan Cancer Support and Dryathlon for Cancer Research UK.

Many of us will be hosting or attending coffee mornings and some of us may even be going dry for September to help raise funds for cancer. With almost half the UK population estimated to be diagnosed with a form of cancer within their lifetime[1] you’ll be hard pressed to find someone that has not known someone affected, or been affected themselves, by cancer. MacMillan Cancer Support estimated that by the end of 2016 1,000 people will be diagnosed with cancer every day.[2]

But it’s not all doom and gloom… while incidents of cancer may be on the rise, so are survival rates. People are living 10 times longer after a cancer diagnosis than they were 40 years ago and half of people with cancer are expected to survive for at least 10 years.[3] But is just surviving cancer enough?

Let’s take a closer look at costs. Macmillan’s ‘Cancer’s Hidden Price Tag’[4] research report reveals the sheer scale of the financial burden faced by people living with cancer. On average:

- Four out of five cancer patients lose £570 a month.

- One in three loses £860 a month in earnings because they are unable to work or have to cut down their hours.

- Six in seven see their monthly expenses increase by £270 a month.

The cost of cancer is calculated as the loss of income and the additional costs experienced as a result of a person’s diagnosis.

MacMillan also looked into what surviving cancer looks like and found that around 25% of survivors deal with poor health or disability after treatment ends and estimated that 500,000 living with cancer in 2010 have one or more physical or psychosocial consequences that affects their lives long-term.[5] While it’s great news that more and more people are surviving a cancer diagnosis and getting the all clear after treatment that doesn’t necessarily mean you will be fighting fit and back to what was “normal” before your diagnosis. It can be a tough pill to swallow once the new picture of your future becomes clear.

You can’t protect yourself from getting diagnosed with cancer but you can be prepared financially if you are diagnosed. How would you deal with a diagnosis? Advances in medicine and rising survival mean you may recover from your illness but what if you could not cope with going back to work?

You can do more than just survive cancer, having proper protection in place means you will continue living with minimal disruption once you have undergone treatment and fully recovered.

For more information about critical illness cover, call 01224 316200 or fill in our online enquiry form

Source:

1. http://www.bbc.co.uk/news/health-31096218

2. http://www.macmillan.org.uk/documents/aboutus/research/keystats/statisticsfactsheet.pdf page 5

3. http://www.macmillan.org.uk/documents/aboutus/research/keystats/statisticsfactsheet.pdf page 7

4. http://www.macmillan.org.uk/Documents/GetInvolved/Campaigns/Costofcancer/Cancers-Hidden-Price-Tag-report-England.pdf

5. http://www.macmillan.org.uk/documents/aboutus

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.

How long would you survive on your savings?

/in Protection /by Neil CarruthersA recent study from Shelter revealed that more than a third of families (37%)1 in England could not afford to pay housing costs for more than one month if they lost their income and 23% of working families would be unable to pay housing costs at all.

For some families, losing income and having to rely on savings means losing your home could become a real possibility.

Income Protection is important whether you rent your home or have a mortgage. If you get ill, lose your job or have your hours cut how will you pay your rent and utilities? Do you have enough savings to pay your bills while you find another job or recover from an illness?

Income Protection isn’t just about protecting your income. It also protects your home and livelihood so you can focus on finding a new job or getting better instead of where you will sleep tonight or if they will eat today.

Source:

1. https://www.theguardian.com/money/2016/aug/09/england-one-in-three-families-one-months-pay-losing-homes-shelter-study

Lifetime Finance Group Limited trading as Aberdeen Mortgage Company is an appointed representative of PRIMIS Mortgage Network, a trading name of First Complete Limited, which is authorised and regulated by the Financial Conduct Authority for mortgages, protection insurance and general insurance products. The Financial Conduct Authority does not regulate some forms of Buy to Let. Lifetime Finance Group Limited.